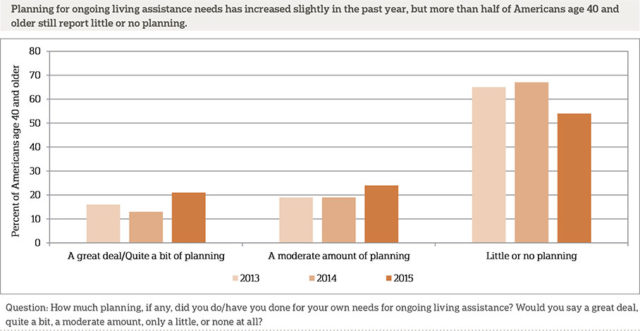

Many Americans fail to see the significance of long-term care planning that they delay it or worse, forgo it. Based on a long term care poll, around 54% of Americans 40 years old and older reported doing little or no planning for their future care needs.

They learn it the hard way, seeing their retirement funds dwindling because of expensive long-term care costs or relying on their adult children to take care of them or to pay for their care expenses.

There are some cases wherein adult children are held responsible for their parent’s nursing home costs. Through filial support laws, you might be liable for you’re the nursing home debt of your parents.

So, if you think you’re off the hook when it comes to nursing home financial responsibility, think again.

States with Filial Responsibility Laws

Unknown to many Americans, more than half of U.S states – Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Indiana, Iowa, Kentucky, Louisiana, Massachusetts, Mississippi, Montana, Nevada, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Virginia and West Virginia plus Puerto Rico have filial responsibility laws that can hold adult children responsible for their parent’s long-term care costs, food, clothing and housing.

However, most states that have filial laws don’t enforce them.

Why?

Older adults with little or no income and can’t afford to pay for long-term care rely on Medicaid, and federal law prohibits going collecting nursing home debt from children. Since there is little chance to apply filial support laws, they rarely affect the care recipient’s family.

Some states will hold adult children accountable for their parent’s nursing home bill if all these things are true:

- The parent received care in a state that has a filial responsibility law.

- The parent did not qualify for Medicaid when receiving care.

- The parent does not have the money to pay the bill.

- The child has the money to pay the bill.

- The caregiver chooses to sue the child.

Rare Case Upholding Filial Law

While filial responsibility laws rarely affect families, a 2012 Pennsylvania case was an exception. That year, the Pennsylvania appeals court forced a man to pay his mother’s $93,000 nursing home bill. This is a baffling case considering that the mother had enough money through a pension not to be eligible for Medicaid and the court allowed the care facility to go after the son, whereas filial responsibility laws are designed to empower the state to collect nursing home payments to reduce the burden on Medicaid.

It’s an unusual case given the circumstances. But for some practitioners, these cases might be due to the rising long-term care costs. The average annual cost of a private room in a nursing home is $100,379 while a semi-private room in a nursing home has an average annual cost of $88,348 and these are expected to rise every year.

A more recent case required one sibling to make monthly payments to his brother to pay for their mother’s long-term care expenses. In Eori v. Eori, one brother was paying a significant amount of money for his mother’s care at home and since he was able to prove that his mother doesn’t have sufficient income to provide for herself, the court required his brother to contribute to the care cost.

These laws rarely make the news but these can serve as a strong motivation for people to plan for their long-term care needs to protect their children from filial support laws.

Is Power of Attorney to Blame?

If it happened before October 2016 then yes but if it happened after that then you’re off the hook. Some nursing home facilities require a family member to co-sign for their parent that made them legally responsible for future bills in the past.

Fortunately, new federal regulations were passed including prohibiting nursing homes from requiring adult children or any third party to guarantee care payment. This is definitely welcoming protection to adult children who have other responsibilities including providing for their children, planning for their care needs and saving for retirement. But they still need to be aware of their rights and responsibilities at all times.

Discuss with your Siblings

It’s important for siblings to discuss handling the costs concerning their parents’ care, especially if one sibling is already helping financially. This is to avoid frustrations and animosity among siblings because one sibling is paying and others aren’t. Also, it’s also a way to iron out financial responsibilities among the family before it gets worse and one sibling will resort to using filial support laws to force their siblings to pay their share.

Help your Parents Plan for Long-Term Care Costs If You’re Concerned

Long-term care cost continues to rise that it has become a serious family issue that needs to be addressed early. It’s ideal to plan for care costs rather than face expensive costs without a plan. If not, then you might end up paying for your parents’ expensive nursing home costs. So better help your parents start exploring their options such as buying ALTCP long-term care insurance to make sure that they have coverage for their future care needs and to avoid becoming legally liable to your parents nursing home debt.

We can help your parents explore their policy options and make the right decisions for them, the whole family and their budget. Request for free-long term care insurance quotes today.