Long term care is a prevalent issue that everyone needs to take seriously especially women. There are still many Americans who don’t talk about it despite the fact that a big part of the aging population, 70% of Americans 65 and above, will require some form of long term care.

But why it’s imperative for women to plan for long term care?

It’s because women can live 5 to 10 years longer than men. Other factors include women becoming primary caregivers to their aging loved ones and they will most likely require long term care due to old age, illness or injury.

So to cap off Long Term Care Awareness Month this November, we’ll feature five articles that can give long term care advice to women that can help them understand the need to prepare for long term care, give them tips to surpass challenges that impede their chance to age the way they want in the future and to remind them why it’s important to save up for retirement.

Caregiving is Killing Us: A Nation Of Daughters in Crisis

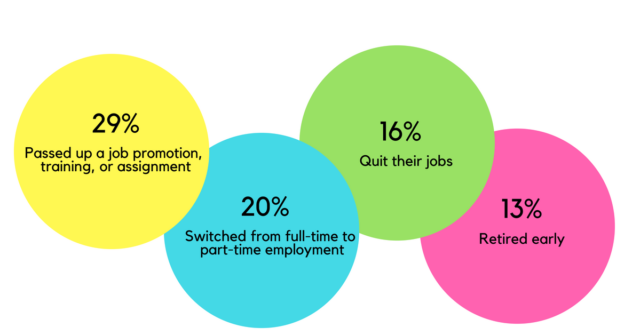

Today, there are around 66% of family caregivers. An average caregiver is a 49-year old woman who juggles working and providing unpaid care to her loved one. Yes, it’s unpaid but it doesn’t mean that it doesn’t cost anything. In fact, women bear significant financial and even emotional and health costs of taking care of an aging loved one.

Female caregivers are responsible for paying for long term care services and facilities, paying for medications or paying for home modifications that are not covered by Medicare or long term care insurance.

Women are at risk of outliving their retirement income because they pay for their loved ones’ long term care needs. Also, they are prone to caregiver burnout, anxiety, depression and other health issues related to caregiving.

Indeed, MsXFactor is right, caregiving is killing female caregivers. However, there are solutions that can make family caregiving bearable such as industry and community support that all female caregivers should seek.

Long Term Care is a Serious Women’s Issue

Atlas Wealth Strategies highlighted facts and figures associated with the long term care dilemma of women and has provided easy to understand illustrations that can serve as an eye-opener to women and in turn will urge them to begin taking the steps in planning for their long term care needs tomorrow.

Women’s lack of financial preparedness compared to men when they enter retirement and the need for long term care makes this gap more evident. This financial woe is deeply rooted in women’s role as national caregivers, which makes it challenging for them to develop a fruitful career, which in turn would provide them with substantial income.

As early as possible, women should start taking steps to plan for their potential long term care needs and explore all available options to avoid financial trouble later on.

Read Next: Why Do Women Need to Plan for Long Term Care?

Impact of Female Baby Boomers on Senior Living

Did you know that 56% of women 85 and up lived alone in 2014? This will most likely continue to rise since more baby boomers will eventually need long term care. In fact, experts estimate that individuals 65 and up who will need senior care will increase by 75%, which is equivalent to about 2.3 million people by 2030.

According to Leisure Care, baby boomers are changing the senior living landscape in four ways: increase in the continuum of care communities or life plan, focus on technology, priority on convenience and city living and having a plethora of options in one facility to enhance their retirement experience.

It seems like the baby boomer generation particularly aging women will break records on senior living and can give new meaning to what it takes to age in the United States.

Related: Baby Boomers Retiring: 5 Tips to Avoid Facing Expensive Long-Term Care Costs

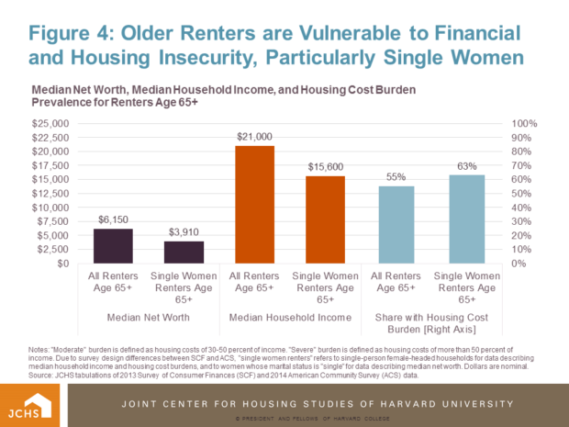

Older Single Women Face Housing Challenges

Boomer Café raises an important housing issue that concerns aging baby boomers. Based on The Harvard Joint Center for Housing Studies, “As Baby Boomers Age, Older Single Women Will Face the Greatest Housing Challenges,” older single women who rent are at risk of falling into housing and financial insecurity. The annual median income for single women 65 and up in 2014 was $15,600, which is below the average cost of long term care services such as adult day health care which is $17,680 and full-time homemaker services, which is $45,760.

It will be more critical for policymakers and long term care providers to make sure that older single women will have access to tools and communities that can allow them to age with grace and dignity.

Check out our Retirement Guidelines for Every Single Person

How Women Who Retire With Their Husbands Often Lose Out

According to NerdWallet, married women who retire with their husbands might be giving up more wealth than they realize. Married women are usually at their peak earning money in their 50s and early 60s, while their husband’s earnings are declining according to Nicole Maestas, associate professor of health care policy at Harvard Medical School.

Married women face extra risks since they live longer and will most likely spend more in retirement. In fact, 80% of women will most likely than men to live in poverty after age 65 based on the National Institute on Retirement Security.

The best thing women could do is to either delay Social Security or retirement altogether to make sure that they will not outlive their retirement income.

Conclusion

Women should plan for long term care and explore their options early considering that they are at high risk of requiring long term care and they lack financial planning compared to men. We can help by giving female caregivers long term care advice, tools, resources and support they need to overcome challenges that hinder them from growing old with grace and dignity.