Long term care facts can help people determine which is true information from what is not since there is an abundance of long term care statistics and information readily available today. When the topic at hand is what you might need in the future, sorting facts from myths early is vital.

To help sort of the facts about long term care from the misconceptions, here are nine misconceptions that many people believe to be true.

9 Must-Know Long Term Care Statistics and Facts

Misconception 1: “I am healthy. I won’t need long term care.”

70% of people age 65 and older will need some form of long-term care in the next few years.

US Department of Health and Human Services

Misconception 2: “My savings are enough to cover any form of care that I might need.”

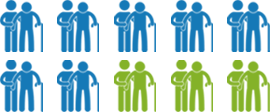

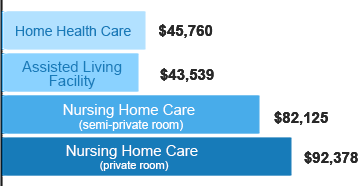

Currently, Americans between the ages of 55 and 64 have an estimated $104,000 in their savings accounts. While this might sound substantial to many, it is not nearly enough to cover the average cost of long-term care in the country, especially when many individuals end up needing care for years.

Genworth 2016 Cost of Care Survey

Misconception 3: “I can postpone planning. I have time and I am still young.”

Long-term care is not just the concern of the elderly. Nearly 41% of long term care recipients are people under the age of 65. These are the once requiring assistance because of illnesses, injuries, disabling conditions, or accidents.

Federal Long Term Care Insurance Program

Misconception 4: “Medicaid/Medicare will cover my long term care needs.”

Medicare does not pay the largest part of long term care services, which include personal care and custodial care. On the other hand, Medicaid does pay for custodial care and medical care, but only for people with low income and assets. But, long-term care insurance can give you comprehensive coverage.

US Department of Health and Human Services

Misconception 5: “My health insurance covers long term care.”

In general, health insurance covers only very limited and specific types of long term care – even less than Medicare.

US Department of Health and Human Services

Misconception 6: “My family will take care of me.”

By relying on your family for the care that you need, you put them at risk financially, physically, emotionally, and mentally.

Misconception 7: “Long term care means going to a nursing home.”

Long term care does not necessarily equate to moving to a nursing home. Depending on the level of care that you need, you can choose to receive care in your own home like 43% of individuals who chose this option. There are also other options such as adult day care and assisted living facilities.

Misconception 8: “Some illnesses are incurable. Preparing for them is a waste of resources and time.”

Incurable diseases, such as Alzheimer’s and Parkinson’s, require more careful planning because these involve loss of executive functions. These diseases often take time to progress. You will need to take specific measures to make sure that your wishes are carried out when you can no longer decide for yourself.

Misconception 9: “It is too late to plan. I am retiring soon.”

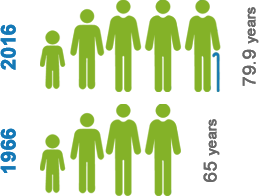

Average life expectancy in the U.S. did not reach 65 until 50 years ago. But now, the average life expectancy of Americans is at 79.9 years. Life during those years could be comfortable with sufficient planning.

Journal of the American Medical Association

Start Planning for Long Term Care

Separating long term care myths from facts is essential when planning for long term care. By taking note of these misconceptions, you can prepare for your future care needs particularly the rising cost and avoid becoming a financial burden to people you love. The best way to prepare for your care needs is by buying for long term care policy.

We, at ALTCP can help you review your coverage options and make an informed decision. Feel free to call us at 800-362-8837 to discuss your options or you may request for free quotes.

Related Articles

Cost of Long Term Care

Learn about the current cost long term care services and facilities in all U.S states.

Long Term Care Insurance

Understand how long term care insurance works and its value to you and the people you love.

Get In Touch With Us

Our specialist will help you tailor a policy that is perfect for your care needs at no cost.