Most Americans today are concerned about retirement particularly their retirement expenses. But unlike before Americans are more optimistic about retirement based on the New Generations Ahead Study by Allianz Life.

The study was conducted among 3,000 Americans – 1,000 baby boomers (52-70 years old), 1,000 Gen Xers (37-51 years old) and 1,000 millennials (20-36 years old). According to the study, only 50% of baby boomers think that it is impossible to pinpoint retirement expenses, which is down from 60% back in 2014 and only 36% think that they lack the tools to figure out retirement, which is down from 46% in 2014.

This is indeed a great improvement and an indication that more Americans will be ready for retirement. Paul Kelash, the vice president of Consumer Insights for Allianz Life agrees and gives validation that through engagement and proper focus, American can turn around their hapless situation and start building a successful retirement.

“Whether taking lessons from the past or forging a new path, the key for each generation is to recognize that a solid retirement plan doesn’t happen by chance, but rather with a clear process and defined actions.” – Paul Kelash, Allianz Life

So what are these retirement expenses that you should plan for?

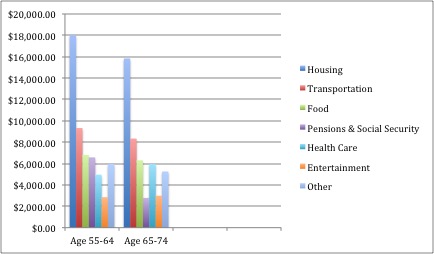

According to data from BLS or Bureau of Labor Statistics, these are the spending patterns of Americans 55 years old and above:

To know more about different major expenses and how to address them, we have featured five blogs that can shed light on this pressing issue:

Revealed! What We Spent In The First Full Year of Retirement

Different things indeed work for different people. Just because a certain strategy works for most people also means it should work for you too. You need to consider certain factors like the city you live in, food, transportation, your chosen lifestyle and more. J.P of The Money Habit has been very honest and sharing his retirement spending and how it has been working for them. Setting a budget is clearly important but not to the point that you are depriving yourself. Continue doing what is working and at the same time make sure to cut in some areas that will help you be under the budget you set.

Living A $100,000 Lifestyle on $40,000 Per Year – 2016 Expenses in Review

How is it possible to live well on $40,000 annually with three kids? Justin of Root of Good explains in details how he managed to spend around $40,000 annually with minor sacrifices. Setbacks can happen, and in the case of Justin and his family, they went above their $2,900 budget for auto and spent $9,428. They spent a lot in that area, but the family was able to recover and went below their budget for expenses like housing, food, clothes, insurance, vacation, other core living expenses and other discretionary expenses.

Anticipating Expenses in Retirement

Has anyone heard of lumpy expenses? Kevin Reardon wrote in Shakespearewm, that most people blow their budget because they fail to anticipate so-called “lumpy” or one-time expenses even if it is a no-brainer to anticipate these expenses. Here is a list of expenses you should include when planning for retirement:

- Home repair or modification – you’ll need to make necessary changes for your homes like new furnace, roof, and others.

- Weddings – Anticipate the cost of your unmarried children’s marriage.

- Cars – Cars don’t last a lifetime. Sometimes it is more costly to maintain an old car than to buy a new one. But make sure to set a budget and factor in the sale price of your current car before making a purchase.

- Family – Consider occasions like 50th anniversary, birthday, wedding, and graduation. Anticipate as many family-related events or special occasions as you can.

- Others – It’s your retirement, and you’re the only one who can determine other lumpy expenses you will spend money on.

6 Retirement Healthcare Costs to Prepare for Now

Brighthouse Financial shares six retirement expenses you should prepare for and tips how to help keep your financial goals on track. Healthcare costs continue to skyrocket these days, so it is imperative to include Medicare premiums, prescription drugs, dental care, vision care, extended medical care and long term care. The best way to handle these expenses is by consulting a financial professional and considering getting a combination of financial tools such as annuities, life insurance and long term care insurance.

The Unexpected Costs of Caring for an Aging Parent

There are 66 million family caregivers in the United States today according to the National Alliance for Caregiving. This means that about 40% of the U.S adult population is taking care of people who are sick and disabled, but majority of these caregivers are taking care of an aging family member. According to Brad Breeding of MyLIfeSite, caregivers help their loved ones with their ADLs or Activities of Daily Living and financially as well. The cost of caregiving is very expenses. As a matter of fact, family caregivers spend nearly $7,000 on average annually to help their loved ones pay for food, utilities, medical bills, long term care and more.

Final Thoughts on Retirement Expenses

To achieve financial independence, Americans should continue being optimistic with retirement, consider all the major retirement expenses mentioned above.

Planning for retirement can be complex and can get daunting but not if you start planning early and consulting a professional. It pays to plan to live a comfortable retirement and also to protect your loved ones from unexpected retirement expenses. Mixing up financial tools like savings plans, annuities, life insurance and long term care insurance can help secure your future.

Thank you for these great content resources ALTCP, and for educating people on such important issues. People should remember to plan not just for the cost of care that may be needed in the future, but also for access to care; i.e. being educated on the various types of care and housing available, and having conversations with your family members.