Long term care insurance coverage provides myriad of benefits like funding for home health care, adult day care, nursing home stay and assisted living facility services. It helps cushion the blow that comes from long term care costs by covering some if not all expenses a policyholder accrues. On top of that, these policies protect the savings and assets of older adults from these expensive care costs.

Download our free ebook Long Term Care Insurance: Definition, Costs, and Policy Details to learn more about how the policy works.

These plans provide the financial safety net that many baby boomers wish to have as they navigate retirement. However, these are not just the benefits that come with having long term care insurance. Let us explore the three underrated benefits of long term care insurance:

The Opportunity to Age in Place

Older adults just want the ability to grow old independently. They want to age in place or be able to receive care safely, freely, and comfortably in the place that they choose. Not many people realize this, but long term care insurance can make that possible.

If you look into long term care insurance information, you will find that these policies offer coverage for home health care. This means that older individuals can receive care at home, granted that their health conditions permit them to do so.

Considering remodeling your home to make it perfect for aging in place is a smart idea because it provides myriad of benefits compared to moving to assisted living facilities and the likes.

Benefits of Aging in Place

- You can continue living at home

- Maintain independence

- Reduce the amount of change in their lives

- Lower health care and long term care bills

- Feel safe in a familiar environment

- Affordable than other living options

- Lots of space for personal possessions

- More inviting for family and friends

- You can keep pets

- Reduce the risk of illness

- Has potential for high home resale value

Peace of Mind in Growing Older

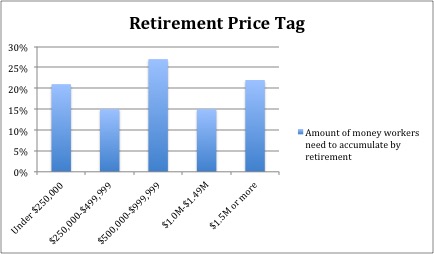

Retirement is changing, and many baby boomers are not comfortable with the new developments. As you know by now, long term care expenses have been increasing in the recent years, and Social Security benefits seem to be standing on unstable ground. So many other financial challenges and issues are being thrown their way that many are hesitant to even retire on time. In fact, 6 out of 10 baby boomers state that they do not feel confident about having enough money to cover long term care needs.

credit: Employee Benefit Research Institute and Greenward Associates

Through an insurance policy, soon-to-be retirees get the peace of mind in knowing that they have the funds stored away in case they need care services. They can focus on other the financial aspects of retirement.

The Wellbeing of Family Members

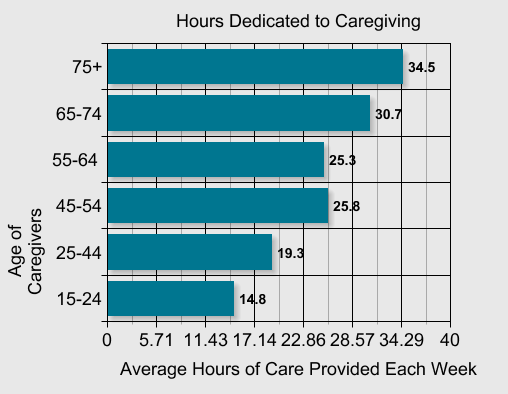

Family members become caregivers when one falls ill. When this happens, they expose themselves to significant difficulties that family caregivers face. They put themselves at risk financially, emotionally, mentally, and physically just to fill the care demands of their loved ones.

credit: www.caregiver.org

Long term care insurance prevents this from happening because it provides the means to avail of paid care. Instead of relying on family members, care recipients have easier access to services provided by the professionals.

However, many are still quite hesitant to dive in and purchase a policy. Some deem it is unnecessary without really exploring the benefits of long term care insurance. They see long term care as something they can easily avoid by eating right and exercising regularly. After all, many still mistakenly view long term care as nursing home care.

Sadly, many do not discover that long term care is not as easily avoidable as they choose to believe until it is too late. By then, they are left with high service costs that they must pay through other means. This is why being proactive about long term care plans is absolutely vital. Learn about the different aspects and discover the benefits that they present. If you do not, then you could be missing a great opportunity to secure your future.

You can get started with your long term care planning by requesting for long term care insurance quotes online now. Feel free to reach out to Association for Long Term Care Planning (ALTCP.org) if you need assistance in understanding the ins and outs of long term care insurance and how you can take full advantage of its benefits.

2 thoughts on “3 Underrated Benefits of Long Term Care Insurance”