Last Updated On:

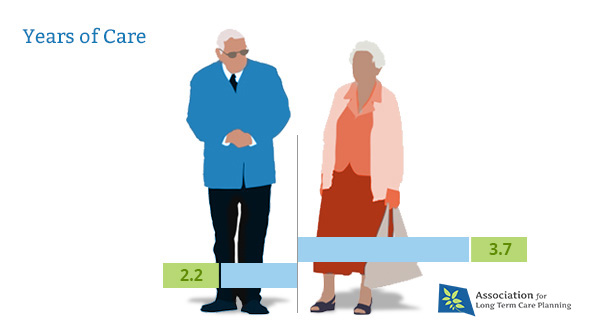

People are living much longer these days. In fact, 70% of Americans 65 and above will require any form of long-term care. Your health insurance will not cover your care needs. Relying on Medicare and Medicaid is too risky since these government programs only provide limited coverage and only if you meet eligibility requirements. While long-term care insurance can help fund your care needs to age the way you want.

Before you shop for coverage, it’s important to learn more about this policy first.

What is Long-Term Care Insurance?

Long-term care insurance is a policy that helps pay for home care, nursing home, assisted living facility and other types of long-term care facilities. Policyholders pay premiums that are based on whether they might have illnesses or health conditions that could require ltc services but not shorten life spans

Individuals who purchase long-term care insurance policies are those who wish to protect their assets, savings, resources, and family members from the potentially devastating costs.

What Does Long-Term Care Insurance Cover?

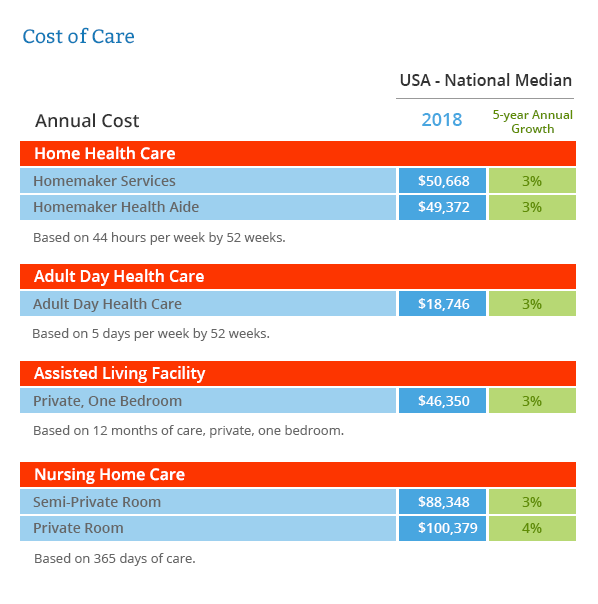

Long-term care insurance covers different types of long-term care services such as home care, nursing home, assisted living facility, adult day care and more. According to ALTCP cost of long-term care, the average daily and monthly costs for U.S states are as follows:

- $267 a day or $8,121 per month in a private room in a nursing home.

- $235 a day or $7,148 per month in a semi-private room in a nursing home.

- $123 a day or $3,750 per month in a one-bedroom unit in an assisted living facility.

- $70 a day or $1,517 per month in an adult day health care.

- $131 a day or $3,994 per month for homemaker services.

- $135 a day or $4,099 per month for home health aide.

The amount, however, depends on the type of services required and the duration of the actual care. For some health conditions that require years or even decades of care, such as Alzheimer’s disease, these costs can reach immense amounts.

To get a better view of how much long-term care services cost financially, here is a breakdown of the annual prices through the Cost of Care Survey released by Genworth last year:

Bear in mind that these figures are simply the average. In some states, these costs can go up to hundreds of thousands of dollars. Various online articles point to Alaska, Connecticut, and Massachusetts as the expensive states for long-term care.

Read Next: Complete Guide on What is Covered by Long Term Care Insurance

Are you aware: Louisiana, Oklahoma, and Texas are 3 of the 10 cheapest states for long term care. (Infographic)

Moreover, the cost of long-term care is not just financial. Because of the lack of resources of older individuals to pay for these services, they end up relying on their loved ones for the care. When this situation happens, their family members and loved ones face the emotional, social, mental, and physical costs that come with providing care. They become part of what is now known as The Sandwich Generation or the group of individuals stuck between caring for aging or ill loved ones and raising their own children. They end up paying thousands of dollars for out-of-pocket costs related to ltc, which means that they barely have enough to cover their needs and prepare for their own futures.

Without long-term care insurance, people facing care risk beginning this cycle that affects multiple generations in their own families.

Do I Need a Long-Term Care Policy?

Long-term care insurance is best described as a product that provides Americans the means to fund long-term care facilities and services in case they can no longer carry out simple daily tasks such as eating, going to the bathroom, getting dressed or going to one place to another due to old age, illness or accident.

Getting a long-term care policy is a good idea under these circumstances:

When to Buy Long-Term Care Insurance?

A person who purchases a long-term care insurance policy at 40 or 50 will pay lower premiums than those who buy in their late sixties. 21% of Americans 55 years old and below and 52% of those who are between 55 and 64 years old have purchased long-term care insurance.

Industry experts have always been adamant that the best time to purchase a policy is when the person is young and healthy, and they can qualify for coverage. This is because insurance providers value these two traits in their potential policyholders. Individuals who fit the bill can get various discounts such as good health discount which some companies offer up to 10%.

Read: What’s the Best Age to Buy Long Term Care Insurance

How does Long-Term Care Insurance Work?

Establish Care Need

Once you start to need care, a licensed health care practitioner must certify first that you are chronically ill and submit a plan of care with the recommended long-term care services.

Trigger Your Benefits

You need to meet two criteria: the benefit trigger and the elimination period before long-term care insurance starts paying benefits.

Benefit triggers are defined as the qualifying events to qualify for long-term care benefits. You can trigger your benefits when you can no longer two or more of six Activities of Daily Living or ADLs on your own or if you have a cognitive impairment such as Dementia.l

The elimination period is the length of time that must pass after a benefit trigger happens before your long-term care insurance starts paying for your long-term care expenses.

Payment of Insurance Benefit

Once you’re eligible for benefits, you can choose how you will receive your policy benefits. One option is through reimbursement benefit.

What are my Options?

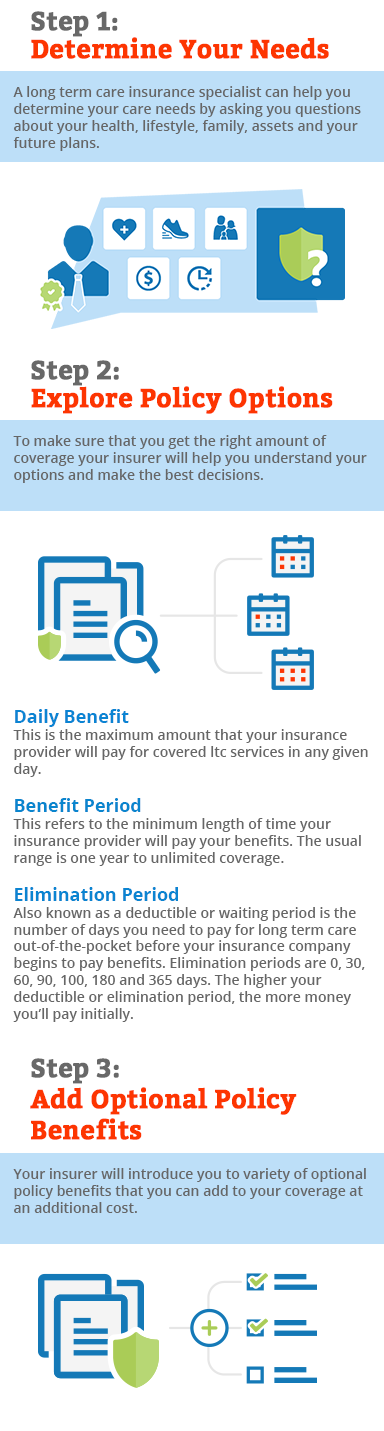

Since long-term care insurance is not a one size fits all, we offer a variety of built-in and optional features to help you tailor a policy that is right for your care needs.

Built-in Benefits

Cash Benefit

This rider is advantageous for people who wish to receive care at home. This is because this feature allows them to receive their cash benefit on a daily basis, regardless of whether they received care that day or not. It also entails that the coverage starts once one hour of care is used.

Moreover, people receiving care from loved ones can benefit from this because they do not need to provide the bills after eligibility is established. This means that care recipients can use the money to pay for services provided by family caregivers.

Care Coordination

Your policy gives you access to the services of a care coordinator or licensed health professionals that will assess your care needs, develop a care plan tailored to your needs and help arrange needed services.

Alternate Care

There might be instances wherein you’ll require services that are not yet available today but may be offered soon. Your coverage can help fund this type of care as long as a care coordinator recommends it.

Waiver of Premium

This policy benefit allows you to stop paying for premiums while you’re receiving covered long-term care supports and services.

Optional Benefits

You can add these benefits to your policy at an additional cost.

Inflation Protection

Many individuals view this long-term care insurance rider as an absolute must when purchasing a policy, despite the chances of it increasing premiums. The three types are as follows:

- Future Purchase/Guarantee Purchase Option – This allows policyholders to increase their daily benefit amount every two to three years without having to meet additional underwriting. However, this may be expensive because each new offer is based on the policyholder’s current age. Insurers may also stop offering this option after two to three tries.

- Simple Inflation – This increases the daily benefit by 5% every year. By the 19th year and a half, a policyholder’s daily benefits will have doubled. However, as this type is typically included in the premium prices, the costs will increase by 40% to 60%.

- Compound Inflation – This type increases the daily benefit by 3% to 5%, compounded annually. Experts have cited that this is more beneficial to younger and healthier individuals.

Shared Care

Couples typically require two expensive plans to ensure that both individuals are covered. Naturally, this is worrisome, especially with the way the costs have been increasing over the years. In fact, studies show that approximately 25% of couples age 65 can expect to spend half a million on long-term care services.

The shared care feature in long-term care insurance policies allows couples—married or not—access to coverage that is enough for two individuals. This means that through this rider, couples get to combine their benefits into a pool which they can both have access to. So, for example, if both individuals have three years worth of coverage, they have six years between the two of them.

Survivor Waiver of Premiums

In case no claims were made against either policy when a spouse dies, the survivor’s premium will be waived permanently. But this varies depending on insurance companies.

Return of Premium

This is a type of rider that will return all or a portion of your premiums to your beneficiary upon the policyholder’s death.

Restoration of Benefits

This ensures that maximum benefits are enforced if you receive benefits for a certain period of time, then recover and stop receiving benefits for a period of time.

Nonforfeiture Benefits

This rider allows the policyholder to retain some policy benefit that is usually equal to the premiums paid-in just in case you lapse your policy. There are some states that require this provision.

How Can I Personalize my Policy?

Where Can I Buy a Long-Term Care Insurance Policy?

Purchase policies from reputable long-term care insurance providers. Individuals must take the time to do research on insurance carriers to determine their stability and dependability.

Here are some of the best companies that sell long-term care insurance today:

| Mutual of Omaha |

|---|

| TransAmerica |

|---|

| Genworth |

|---|

| LifeSecure |

|---|

What’s Next?

Start taking the steps in protecting your family and yourself today to make sure that you can age however and wherever you want, and to avoid becoming a financial liability to your loved ones. We can help you explore your policy options and you can begin comparing policies from top providers, features, benefits and estimate costs to find the perfect coverage for you. Get started by completing our quick quote request form.