Many older adults are determined to stay in their home for as long as possible. In fact, 90% of individuals over 65 years old want to age in place.

But why?

For older adults, they prefer to age in a place they are familiar and comfortable with. The change in environment and routines might confuse them but if they stay home, they can age in place they know best. Also, they don’t want to leave behind the memories and history of their homes.

However, they will most likely require help at some point in carrying out their daily living activities – eating, bathing, toileting, dressing, transferring and continence, nursing services, and household chores. In order to live independently, older adults might need home health care. Unfortunately, those who will most likely need home health services are the least likely to afford it for long-term according to a new study.

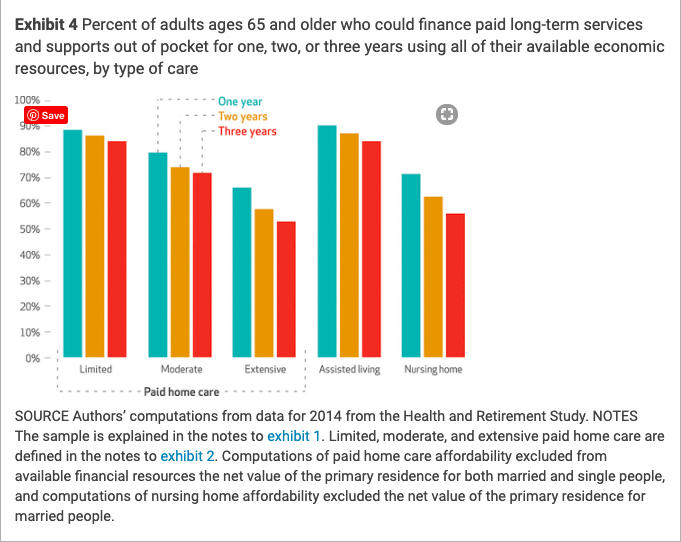

Based on the costs of paid home care: limited care of 25 hours per month that costs $475, moderate care of 90 hours per month that costs $1,170 and extensive care of 250 hours per month that costs $4,750, the researched of the University of Michigan’s Institute for Social Research got initial results that looked promising.

Around 74% of people 65 and above could pay for 2 years of moderate home health care while 86% can pay for at least 2 years of limited paid home health care.

Did you know: Men would need long-term care for an average of 2 years and 2 months while women would need care for an average of 3 years and 7 months.

But the next set of results is alarming.

Many aging individuals who will most likely need home care – those with a cognitive condition such as Alzheimer’s or Dementia or who need help in carrying out at least two of their activities of daily living couldn’t afford paid home care.

Only 57% of these older adults could afford 2 years of moderate home care, and only around 40% could afford 2 years of extensive home care.

What do these numbers mean?

According to Richard Johnson of the Urban Institute’s Income and Benefits Policy Center, in Washington, D.C, these will have a massive impact on families of these aging individuals. Instead of hiring home health care professionals, they rely on their family members for unpaid care.

Eventually, the constant caregiving duty will take a toll on their family members, which significantly brings down the level of care they provide to their aging loved ones. When this happens, care recipients might end up moving in a nursing home.

Is there still a way for older adults to pay for home health care?

YES…

If You Plan Early

You’re in your prime to plan for long-term care when you’re in your 50s. You should start looking into different home health care providers and exploring different payment options.

Does Medicare Cover Home Health Care?

Yes and no.

Medicare will pay for skilled nursing services, skilled therapy services, medical supplies, durable medical equipment and the likes. But Medicare doesn’t cover personal care – assistance in performing ADLs, homemaker services – household chores and shopping, and occupational therapy.

If you’re thinking of using Medicare to pay home health care services, you better think twice.

Related Article: Medicare and Long-Term Care: What’s Covered?

Does Medicaid Cover Home Care?

All 50 U.S states have Medicaid programs that cover home care. In fact, family members can get paid for caregiving duties in some states. But take note that Medicaid only helps low-income aging individuals and its asset and income limits differ from one state to another.

For example, Minnesota’s income limit is $2,250 and its asset limit is $3,000, while in New York, an aging individual must have an income that is lower than $845 and assets lower than $15,150 per month in order to qualify for Medicaid home care coverage.

Read Next: Are You Thinking of Paying Your Long Term Care with Medicaid? Better Think Twice

Is There Another Way to Cover Home Health Care Costs?

Long-term care insurance pays for long-term care facilities and services such as home health care. It’s a type of policy that helps you age in place and protects your assets and as well as your loved ones from the rising cost of home health care. Also, take note that there are policies that pay family caregivers.

Experts encourage individuals to buy long-term care insurance as early in their 50s to save on premiums and to make sure that they’ll qualify for coverage.

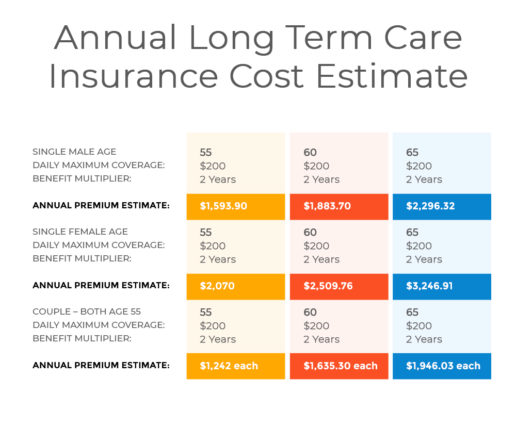

For example, a single male 55 years old and has a daily benefit of $200 for 2 years has an annual premium estimate of $1,593.90 while a single female 55 years old with the same benefits has an annual premium estimate of$2,070. Here’s the rest of the cost of long-term care insurance.

What’s Next?

Aging in place comes with a price, which also includes becoming a burden to your family. So while it’s still early, plan ahead to make sure that you can afford home health care when it’s time and avoid asking your family to take care of you or your home care expenses.

We can help you stay in your home for as long as you want by helping you explore your options and come up with an educated decision that can protect you and your family in the future. Call us at 800-362-8837 to know more about your options or you can request for no-obligation online quotes.