Last Updated On:

The number one question caregivers always ask is this, “how to get paid for being a family caregiver?”

Caregiving for a family member is done out of love, and there is no monetary compensation attached to it. Since this is mostly the case, taking care of a loved one can be burdensome especially in the areas of the caregiver’s finances.

Remember that caregiving requires a great deal of attention and time. If you are taking care of an elderly parent or an impaired family member, chances are you’ll have to lessen your work hours or quit your job completely. This can mean a smaller income or none at all. If you’re facing this dilemma, don’t fret as you can get paid for family caregiving. Here are the ways how to get paid for being a family caregiver.

Get our free infographic 18 Enlightening Facts about Caregivers to learn about the importance of family caregivers.

Medicaid’s Cash and Counseling Program

If you’re loved one is eligible for Medicaid, you can get paid as a caregiver through its Cash & Counseling Program.

Traditionally, Medicaid covers in-home care by covering the care expenses provided by home care agencies. However, these agencies are mostly understaffed; therefore, the care they provide is short of what is required. Due to this, family members share a portion of the care responsibilities and sometimes even exceed the level of care provided by the agencies.

With the Cash and Counseling Program, those people needing care will have the option to choose their in-home care provider. Through this, Medicaid gives them an amount that they can use for care. It can be used to pay their caregiver of choice—which could be a family member just like you. More so, they can spend it on things that can improve their current situation or pay for services such as transportation.

The amount that your loved one will receive will be highly dependent on how Medicaid has assessed his current situation. The current home care rate in your state is also a determining factor. More so, remember that your loved one needs to meet certain conditions to be eligible for this program.

Currently, the Cash and Counseling Program is available in 15 states—Alabama, Arkansas, Florida, Illinois, Iowa, Kentucky, Michigan, Minnesota, New Jersey, New Mexico, Pennsylvania, Rhode Island, Vermont, Washington and West Virginia. Meanwhile, other states have a program that somehow resembles it. Some of them provide monetary benefits to seniors even if their money is not qualified for Medicaid’s asset requirement.

If you want to learn more about your state’s program, you can seek the assistance of Medicaid, Human Services and Social Services.

Long-Term Care Insurance

If your loved one has a long-term care insurance policy, he can use his benefits to pay you for caregiving. However, long term care insurance policies have different conditions when covering in-home care. Typically, they only pay for services that are rendered by licensed caregivers.

If that is the case, you can look into your options of being certified by seeking help from the National Family Caregivers Association or Family Caregivers Alliance. Typically, you need to attend certification classes which are offered at reasonable rates at local schools and colleges.

Meanwhile, if your care recipient has an indemnity type of long term care insurance, his policy can pay for your caregiving services. An indemnity policy pays the maximum benefit regardless of how much is actually incurred in care services. Since it pays the policyholder directly, your loved one will have full discretion on how the money will be spent. Therefore, he can easily utilize the cash to pay you.

Get your free quote from top insurers now to find affordable long-term care insurance. It will only take 5 seconds!

Veterans Aid

The improved pension for veterans was established to provide financial help. The veteran can be eligible for financial assistance if he or she has been in service for at least 90 days of active duty with one day starting or ending during the war period and has been discharged honorably. The financial assistance is divided into three levels:

Level 1: Basic pension for veterans with the lowest income

Level 2: Housebound benefits for veterans that can get certification from a physician that they need daily help.

Level 3: Aid and Attendance or A and A provides the highest benefits and allows the highest countable income

The improved pension for A and A is given when a veteran or a surviving spouse requires help in carrying out ADLs or Activities of Daily Living such as eating, bathing, walking, dressing and undressing. It also covers people who are in an assisted living facility or nursing home due to mental or physical incapacity and also those who are blind.

However, the VA Comprehensive Family Caregiver Program, which is designed to help veterans with catastrophic service-connected injuries is only available to veterans injured on or after September 11, 2001.

The video below shows Paralyzed Veterans of America Executive Director Sherman Gillums, Jr. shares a breakdown of the what happens when older veterans are denied of benefits of the program, and how you can help to change it.

Supplement Security Income (SSI)

Supplemental Security Income (SSI) program provides benefits to disabled adults and people 65 years old and above without disabilities but meets the financial limits. The program pays benefits either to the elderly or a certain family member who provides caregiving.

SSI benefits are different from Social Security benefits. The benefits are not based on your aging family member’s previous work. They vary based on living arrangements whether the aging person lives in a facility, in his or her own home or someone else’s home.

Tax Breaks

You can qualify for some tax relief if you’re supporting your aging parent. As a family caregiver, you can claim your aging parent as a dependent on your taxes.

You can take advantage of long term care tax deductions if you shoulder at least half of their living expenses. Some medical expenses of aging parents are also tax deductible. But take note that these tax benefits only apply to expenses that are not covered by insurance such as surgery, treatments, preventive care, vision care, dental care, and insulin. However, gym memberships, cosmetic procedures, vitamins and other drugs bought over the counter are not included in tax deductibles.

For those who are in assisted living facilities, the tax benefits will only apply if seniors qualify as chronically ill and they are certified as such. Also, a licensed health care practitioner must prescribe their care plans.

Care Agreement

If none of the options above apply to your loved one, he can opt to use his own money and pay for your caregiving services. If you choose to go this route, come up with a simple agreement. Yes, you are family, and this may seem awkward and unnecessary, but having an agreement in paper avoid conflicts in the future.

In the said agreement, make sure to include the amount that you are to be paid and the duration and amount of care that you will put in. Apart from avoiding rifts and misunderstandings, this document can also work to your loved one’s advantage should time comes that he needs to apply for Medicaid. Your agreement will serve as proof that his money is actually spent on paying for a family caregiver and not just hidden away to qualify for the program.

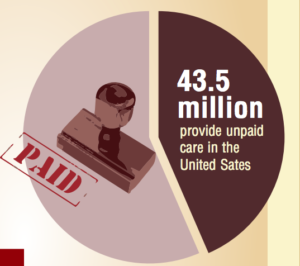

Currently, 39% of adults have provided unpaid care to an adult family member or friend. From 2010, it has considerably hiked up from 27%. This can be parallel to the inclining cost of care as well as the demand for it. Amidst this alarming scenario, it’s still comforting to know that there are different options that can shield family caregivers from financial catastrophe.

Additional Thoughts to Consider

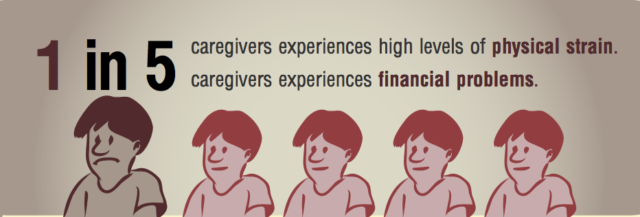

Taking care of a loved one can be physically, emotionally and financially draining. But, what really hurts family caregivers today is the cost of providing care. Taking the role of a family caregiver also means paying for your loved one’s care, daily living expenses, and other necessities. On top of this, you also have other financial responsibilities. This is why you need to give a lot of time to plan for your finances to become an efficient and successful family caregiver.

To help you jumpstart your financial planning, ALTCP provides different tools and resources that can help secure your future while providing care for your loved ones.