Planning for long term care usually starts with the conversation among family members that revolves around designing the policy according to their needs, exploring policy features and finding reliable insurers. Most often than not, individuals miss out two important things, their health history, and underwriting.

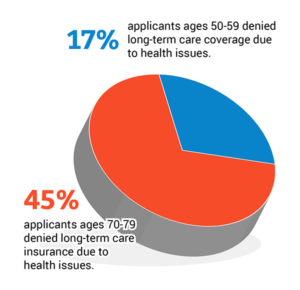

There are a lot of individuals who want to get coverage for long term care. Unfortunately, nearly half of applicants 70 years old and above are declined coverage because of pre-existing conditions.

So, is it really that hard to qualify for long term care insurance?

No.

People mistakenly think that they can get coverage at any age. The truth is, it is harder to qualify for a policy when you’re older because your health condition deteriorates as you age.

To help you qualify for a long term care coverage, here are some tips you can follow.

Proven Tips on How to Qualify for Long Term Care Insurance

1. Buy Policy Early

The best time to buy a long term care insurance policy when you’re healthy, which is when you’re in your 50s. In fact, Sally Hurme, a senior project manager in AARP’s Department of Public Education and Outreach cited statistics based from the National Association of Insurance Commissioner that the average age that individuals purchase long term care insurance is 57.

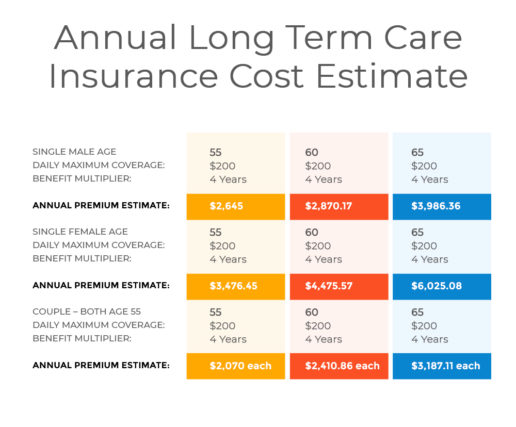

Premiums go up as you get older, so the cost of long term care insurance at age 60 is higher than the cost at age 50. Here’s a long term care insurance price comparison that can help you come up with the best decision.

Read Next: 5 Benefits of Buying Long Term Care Insurance Before Age 50

2. Answer Health Questions Thoroughly

Long term care insurance providers usually conduct telephone health interview and request for your official medical records. Sometimes, a face-to-face assessment in your home is required but this still depends on your age and health condition.

Insurers have added more underwriting today due to adverse claim experience. But their stricter application process is not to increase the number of denied applications but rather to get a case placed. Most declines could have been easily avoided if carriers asking fewer questions and doing a simple underwriting. It would also help if applicants answer health questions truthfully.

Here are some situations that insurers encounter quite often:

- Cancer Patients – Since there are many types of cancers, insurers want to know the exact stage, type of treatment, dates of treatment or any recurrence. Cancer can either be a huge underwriting problem or not.

- Individuals with Arthritis- Insurers want to know the exact type of arthritis when you were diagnosed, what are the joints affected, did you have a joint replacement or whether you’re using any kind of assistive devices. If your arthritis is just mild then you’re still insurable but if it’s not then it’s going to be a deal-breaker.

3. Compare Long Term Care Insurance Companies

Long term care insurance companies won’t sell you a policy if you’re a high risk of collecting benefits soon. However, just because one company won’t approve your application doesn’t mean that other companies will follow suit. There are many companies that sell long term care insurance to choose from, so shop around and consider their consumer reviews and ratings when choosing an insurer.

4. Group Long Term Care Insurance

Group long term care insurance or employer-sponsored policy has loose underwriting, which makes it perfect for individuals with health conditions. Also, premiums of group policies are gender neutral unlike in individual policy that is based on gender, age, the state where you live and marital status. This is perfect for women, who are usually charged higher by insurance providers because they live longer and will most likely require long term care.

With regard to home care benefits, group policies only cover 50%-70% of home care, unlike individual long term care policy that covers 100% of home care. This means that you might pay out-of-the-pocket due to your limited benefits.

Related: Group Long Term Care Insurance vs Individual Long Term Care Insurance

5. Work With Experienced Agents or Brokers

Your long term care insurance agents or brokers can play a big part in the success of your policy application in case you have health conditions. Since underwriting standards of carriers change from time to time, it’s best to seek the help of experienced brokers or agents with access to multiple insurers.

We can help you shop for carriers that offer the best chances of approving your long term care insurance application. Save time and money now by requesting for no-obligation quotes from ALTCP today.