Stars were aligned for baby boomers since they were born – between 1946 and 1964.

Boomers got the education they wanted, and they lived and thrived during the economic surge.

But, are they still having the same luck today?

In line with National Retirement Planning Week, Insured Retirement Institute or IRI released their annual report, “Boomer Expectations for Retirement 2019″ and it speaks otherwise.

To sum it all up, Boomers are facing a retirement crisis today because they don’t have enough savings, they fail to plan for health care and long term care costs and they underestimate their retirement income.

But don’t worry because Boomers are not yet doomed as long as they break these bad habits that stop them from having a comfortable retirement.

Limited Savings

According to Insured Retirement Institute or IRI, only 55% of boomers have retirement savings today, which is 20% lower compared to 8 years ago. What’s more alarming is that half of this only has less than $250,000 saved.

Personal savings are in a bad shape likewise private pensions and Social Security. Around 23% of baby boomers 56-61 expect a pension from a private company, and only 38% of older boomers expect to receive a pension. Social Security, on the other hand, doesn’t give enough lift since the average check is only $14,000 annually.

Draining Retirement Savings

With their little retirement savings, baby boomers make their case worse by spending their savings. About 17% save money for retirement but they spend it because of carelessness or desperation or both.

Underestimating Health Care Costs

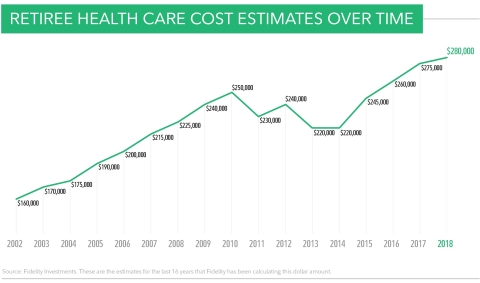

Health care cost is one of the major retirement expenses that baby boomers often underestimate. According to Fidelity Investments’ 16th annual retiree health care cost estimate, a 65-year old couple retiring will need 280,000 to cover health care and medical costs during retirement.

As for individuals, a male will need $133,000 to pay for their health care costs in retirement while women will need $147,000 to fund their health care needs. Women will need to spend more than men because of the fact that women live longer than men.

According to the IRI survey, more than half of baby boomers think that health care expenses will be less than 20% of their retirement income. While 1 in 4 boomers think that health care costs will be less than 10% of their savings.

Read: 6 Useful Tips to Avoid Paying $280,000 Health Care Costs in Retirement

Not Planning for Long Term Care

People are living longer today, which means they are at risk of requiring long term care. In fact, 7 out of 10 of Americans 65 and above will require some form of long term care. Aside from the impending need, people should pay attention to rising care costs. The average annual cost of a private room in a nursing home is $100,379 while it’s $88,348 for a semi-private room in a nursing home.

Clearly, boomers should start taking steps to address this care need. Unfortunately, only 50% of baby boomers have not included health care costs in their retirement plan and only 36% have included long term care cost.

If you’re thinking of relying on Medicare or Medicaid, better think twice since these government programs will not pay for your long term care needs. But, long term care insurance can help fund your expenses.

Check out our infographic: Top 10 Reasons Why You Should Buy a Long Term Care Policy

No Retirement Savings Goal

Who plans for retirement without setting a goal? Surprisingly, there are some baby boomers who save money for retirement without setting a target first. Saving is already hard and it’s a lot harder if you have no idea how much money you need to save.

Overestimating your Retirement Date

Some people postpone their retirement simply because they can’t afford to retire yet. They continue working until they have enough to support them throughout their retirement. Around 29% of people 62 to 66 years old have postponed their retirement while 33% of people 67 to 72 have done the same thing.

But what’s alarming is the number of people who overestimate their retirement date. Based on studies, only 10% of people work past 70 years old out of 31% of boomers who think they can work past that age.

Ignoring Estate Plan

Another shocking revelation from the survey is that two-thirds of boomers have not done anything to protect themselves in case they develop a cognitive condition such as Dementia.

Without an estate plan in place, baby boomers can’t carry out their wishes on how they want to be taken care of and when they can no longer decide for themselves. If you wait too long to set your affairs in order, it might be too late. So it’s best to do set an estate plan as early as you can.

Related: 13 Must-Do Estate Planning Tips

Do you Need Help Planning for Retirement?

We can help you plan for retirement, particularly in preparing for your long term care needs. Get in touch with us to discuss your options and to start taking the steps that can help you age wherever and however at no cost.