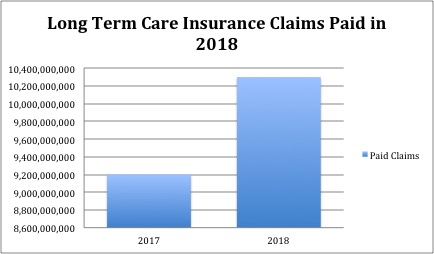

The long term care insurance industry paid a total of $10.3 billion in claims for 2018 according to AALTCI. By far, this is the largest amount of claims paid by long term care insurance companies. From 9.2 billion of claims paid to 295,000 policyholders it rose by 2.7 %, to $10.3 billion and 303,000 policyholders.

Read: The Complete Guide to Filing Long Term Care Insurance Claims

According to ThinkAdvisor’s calculation, the average claim per person rose by 9%, which is around an average of $34,000 per person.

So, what does this mean?

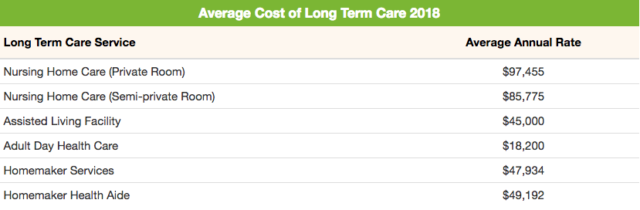

This means that the long term care insurance industry is doing an excellent job in helping Americans pay for their long term care expenses, which are skyrocketing nowadays. The average cost of a private room in a nursing home costs $100,379 while a semi-private room has an average cost of $88,348.

It’s also notable that individuals who own traditional long term care insurance policies increased, which is a good sign for the industry and also to long term care insurance experience of Americans. Right now, there are roughly around 7 million Americans who purchased long term care insurance.

But is this figure enough?

Based on PRB’s fact sheet, there are roughly 46 million Americans aged 65 and up and this is projected to double to over 98 million by 2060. Clearly, the figure is not enough. Americans need to plan for their future long term care needs and get coverage for long term care if they want to age the way they want in the future. For starters, individuals can answer long term care quiz to help them start their plan or talk to a long term care insurance specialist.

Is It Safe to say that Buying Long Term Care Insurance is Worth It?

If you look at the cost of long term care, it’s safe to say that it’s best to have long term care insurance than to shoulder all the costs out-of-the-pocket. Considering the average years that Americans would need long term care will make you realize that owning a policy is worth it. Men would need long term care for two years and two months on average while women would need long term care for three years and seven months on average.

When is the Best Time to Buy a Policy?

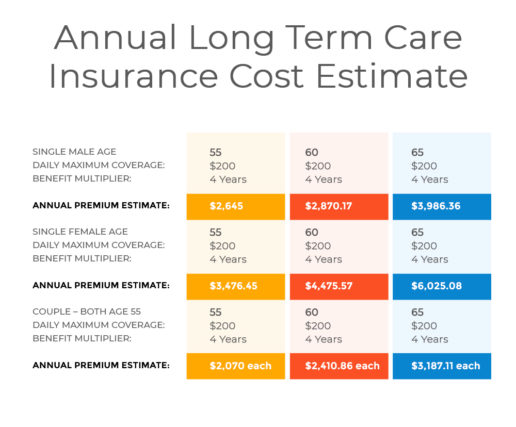

It’s recommended to purchase long term care insurance while you’re still young so you can enjoy affordable premiums. Long term care insurance carriers give health discounts to individuals who buy coverage early.

Here’s a sample computation of the cost of long term care insurance:

Related: What’s the Best Age to Buy Long Term Care Insurance?

Final Words

The record-breaking long term care insurance claims paid this 2018 give Americans a favorable claim experience that proves that this policy is doing an excellent job in protecting assets, paying for expensive nursing homes, assisted living and other types of long term care facilities and services, giving peace of mind and sparing loved ones from financial obligation.

It also gives a strong message that owning long term care insurance can help you live the way you want in the future and protect your loved ones from the devastating cost of long term care.